Empower Your Small Business Through Strategic Financial Management

Effective financial management is critical for the sustainability and growth of any small business. The complexities of managing finances can be streamlined with the right strategies and tools, making the process more accessible and less intimidating.

Adopting these practices not only bolsters your business's financial health but also sets the stage for future success. Let's delve into how integrating smart financial tactics can transform your business operations and lead to long-term prosperity.

Optimize Inventory with Smart Technology

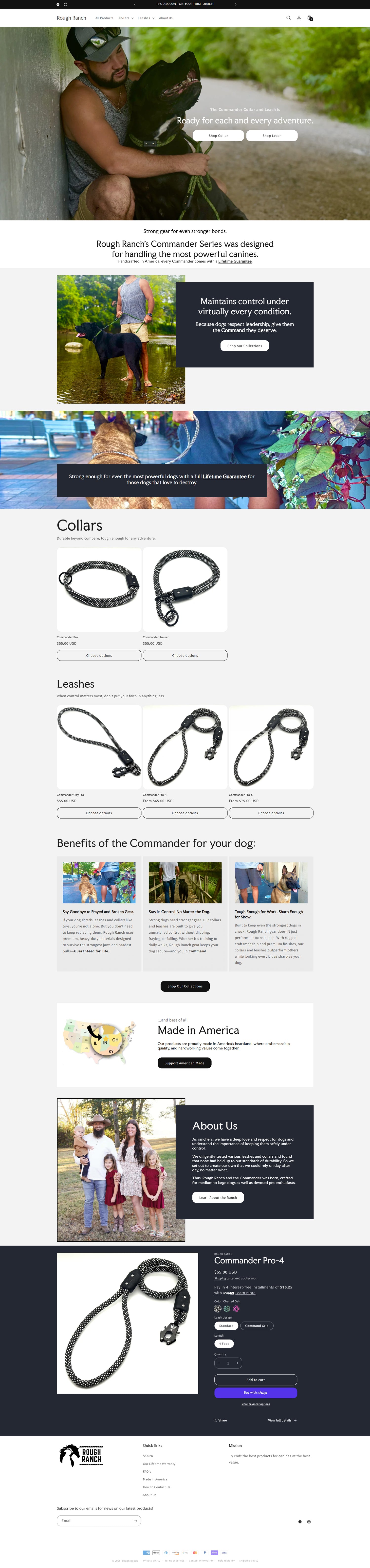

One transformative step you can take is to adopt a point of sale (POS) platform like Square or Shopify that integrates inventory management. This technology allows you to track your stock levels in real-time, ensuring you're never caught off guard by sudden inventory shortages or excesses. With automatic updates and analytical tools, you can forecast demand more accurately, optimize your stock ordering, and reduce waste, thus significantly improving your cash flow and reducing operational stresses.

Consider Forming an LLC

Forming a limited liability company (LLC) can offer you numerous advantages, such as limited liability protection, potential tax benefits, and operational flexibility. Unlike other business structures, an LLC shields your personal assets from business debts and liabilities. Furthermore, the administrative burden is lighter compared to corporations, and the tax setup can be more favorable depending on your situation. You can form an LLC in SC through ZenBusiness, a formation service that can simplify the process for you and ensure that all legalities are handled efficiently without the need for expensive legal services.

Engage with Financial Experts

Collaborating with an accounting professional can bring clarity and precision to your financial management. These experts can provide invaluable insights into cash flow trends, tax obligations, and cost management strategies. Regular consultations ensure that your financial practices align with current laws and industry standards, helping you to avoid costly errors and identify opportunities for financial optimization.

Set and Review Your Budget Regularly

Creating a realistic budget and reviewing it regularly are fundamental steps in financial management. Your budget serves as a roadmap for your business, outlining expected income and expenditures and helping you make informed decisions. Regular reviews allow you to adjust to changes in your business environment, such as fluctuating market conditions or unexpected expenses, keeping your financial goals on track.

Define Clear Business Growth Goals

Setting specific growth goals provides you with clear targets to aim for and motivates you to allocate resources more effectively. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Whether it’s expanding your product line, increasing market reach, or enhancing customer satisfaction, clear goals help you focus your efforts and measure your progress. By clearly defining these objectives, you can better communicate your vision to your team and stakeholders, fostering a unified approach to achieving these milestones.

Invest in a Comprehensive Accounting Platform

Investing in a robust accounting platform is crucial for streamlining your financial operations. Such platforms like Freshbooks or Wave automate many routine tasks, like invoicing, payroll processing, and financial reporting, freeing up your time to focus on core business activities. They also provide real-time financial data, allowing you to make quick, informed decisions. With advanced security features, these platforms ensure that your sensitive financial information is protected against unauthorized access. Moreover, the integration capabilities of modern accounting platforms allow them to work seamlessly with other business tools, enhancing overall productivity and efficiency.

Empowering your business with effective financial management practices is vital for long-term success. By adopting technology that improves inventory management, choosing a business structure like an LLC, engaging with financial professionals, and more, you position your business for growth and stability. With these strategies, you maintain control over your finances and continue to thrive in a competitive market.

Elevate your business with custom Shopify solutions from Charleston WebBuilder—get started on your e-commerce journey today!

*******************************************

written by:Carla Lopez <carlalopez@boomerbiz.org>